Cirrus Market Update Q2 2024: Trends and Insights from Aerista

Spring flying season is finally here! The cold dark days of winter have given way to beautiful flying weather in many parts of the country. With springtime bringing some instability to the atmosphere, so too are we seeing some bumpy rides in the Cirrus market.

Market Overview

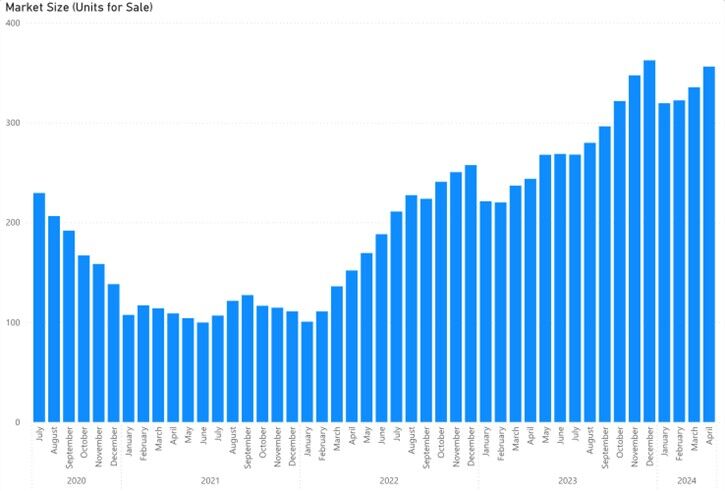

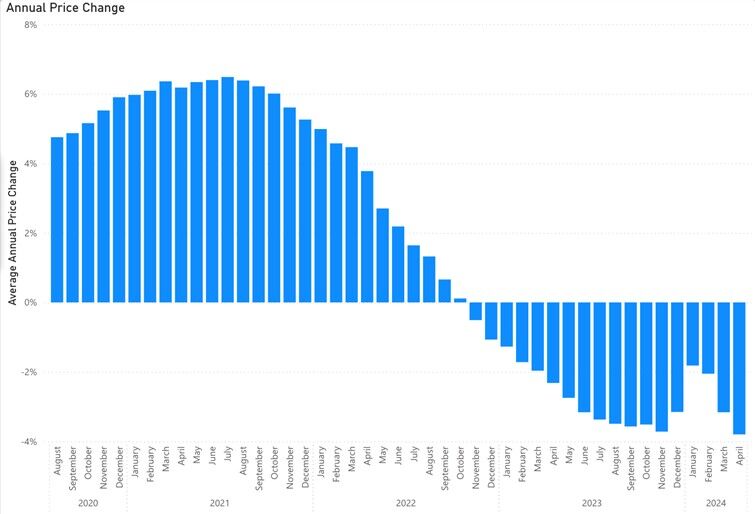

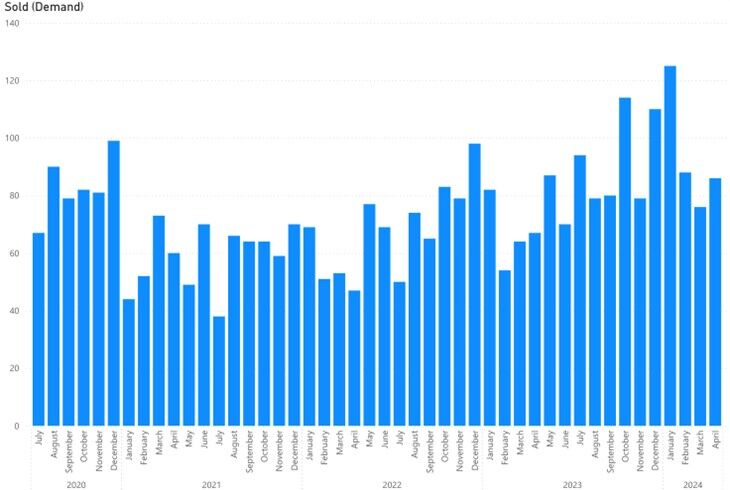

At Aerista, we spend a lot of time monitoring the market and collecting pricing data, and we cannot remember a time when the messaging has been more consistent than it is today. Sales organizations up and down the aviation food chain have been confirming what we, the world’s largest Cirrus broker, are seeing: consistently rising inventory and declining pricing, but surprisingly robust demand. The AeristaMetrics charts (below) show this story graphically.

Inventory is at Historic High

Closing Prices have Fallen with Increased Supply

But Demand remains Strong

Strategy

The buying activity is predominately in the portion of each market segment where the aggressively-priced listings reside. The same cannot be said for the large tranche of units that are wishfully clinging to high pandemic-era pricing. They are languishing, and the message is clear – sellers who price correctly attract buyers and go into contract. Those who don’t, don’t.

That said, a key advantage we (Aerista) have is in knowing not just the list prices (public info), but also the closing prices of the vast majority of transactions. This data helps us bring buyers and sellers together by showing them where recent transactions have taken place. The message on this front is also clear – despite prices declining on the back of rising supply, there is no shortage of buyers ready to purchase a correctly priced Cirrus. So for buyers out there: Yes, there are a lot of listings to choose from, but don’t expect to steal something at a wholesale price. There are simply too many buyers in the market for that to happen.

The Canary in the Coalmine

Aerista’s stats closely mirror the larger industry trends: our unit sales are up 20% YTD vs 2023 – we just closed our 100th transaction of the year! But our gross revenue is only up slightly because average closing prices are down.

Qualitatively, it feels like the market is well balanced between buyers and sellers. And while the decline in yearly prices is 2-3x greater than the depreciation rate we would normally expect, much of this seems to be just a reversion back to the norm. Covid demand drove prices up. Recent supply has lobbed off much of those premiums. While prices may rationalize at a steeper rate for a few more quarters, we expect the rate of depreciation (since new) to settle down in the historic 5% range for the market as a whole. In specific segments those rates will vary, with a newer segments seeing steeper price declines than early model segments

Looking Forward

External factors we are keeping an eye on that may become concerns include high interest rates, the presidential election, and G7 fallout.

Interest rates haven’t dampened demand, or have they? While the number of units purchased has remained strong through the rising, and leveling, interest rate environment, many buyers have simply pivoted to paying cash rather than financing. We can’t help but wonder if demand might not have been even stronger with lower borrowing rates. To date, the primary aviation lenders have continued to hold their loan rates well above the LIBOR spread we had become accustomed to. With LIBOR rates having already declined this year and expectations for a few more rate cuts, if we see the aviation lenders compete for business with lower loan rates, a surge in demand may follow.

The runup to presidential elections generally brings with it volatility and uncertainty, factors which always correspond to a slowdown in transaction volume. However, this effect is likely to be temporary. Regardless of outcome, the removal of uncertainty seems to always lift the pre-owned market. If the post-election stars also align such that expected tax incentives combine with a glut of available inventory, Q4 2024 could be one for the record books.

One factor working to keep a lid on price premiums may be greater-than-expected G7 availability. Cirrus built such a long backlog that many 2024 G7 deliveries are slated for clients who placed orders in 2022. Some of these buyers’ circumstances have changed – some have already moved up to aircraft with greater performance, and some need to cancel their deliveries. To date, we have already seen a handful of “like-new” G7 airplanes transact on the preowned market. The availability of new or nearly-new G7s may further erode the price premiums that have been with us for several years, especially in the late model G6 segment.

Connect with Aerista for Market Insights

At Aerista, we go beyond speculation, relying on data and market insights to navigate the ever-evolving aviation landscape. For a deeper dive into the marketplace or to obtain an estimate of your aircraft’s value, connect with us directly. Visit the AeristaMetrics section on www.aerista.com to explore the data we gather for a better understanding of the aviation marketplace.

Ready When You Are

Aerista stands ready to assist you in navigating the dynamic pre-owned aircraft market. Whether you’re looking to buy or sell your aircraft, our team is here to provide personalized assistance and valuable insights. Reach out to Aerista today.