Fall 2019 Cirrus Newsletter

As we exit a fabulous summer of flying and enter the 4th Quarter busy season in pre-owned Cirrus sales, we thought it would be a good time to provide you with an update on what’s new with Aerista and the Cirrus market.

Signs of a Slowdown?

With all the recent media coverage of slowing economic growth, inverted yield curves and trade wars, you may be wondering if the Cirrus market is showing signs of weakness. The answer is: No, and Yes.

On the upside, market inventory remains historically very low (174 units as of this writing), with only 3.5% of the N. America Cirrus fleet currently for sale. At the same time, demand for factory new aircraft has remained very strong, with Cirrus’ current build-to-order backlog stretching out into Q2 2020. Aerista’s sales activity is also holding steady; we’re within a handful of units of last year’s YTD volume, and 2018 was a record year for us.

The not-so-good news is that inventory in the late model segments (G5 & G6) is starting to stack up, with a total of 5.8% of the fleet for sale across both segments, including 6.9% of the G6 fleet. Almost three full years into G6 production, we believe the G6 market has reached full maturity, but asking prices are in many cases still being held at “near-new” levels. This was appropriate in times of scarcity for both new and pre-owned G6s, but prices will have to start adjusting downward to kick this segment back into gear. If you’ve considered upgrading to a G6, now is a good time to start looking for value; if you’re thinking of selling one, you’ll want to be laser focused on proper pricing and comparable sale data to make sure the market doesn’t move out from under you.

Introducing Aerista Market Monitor (beta)

Earlier this year we rolled out AeristaMetrics 2.0, our new valuation tool which allows us to estimate the value of any Cirrus with more speed and accuracy than ever before.

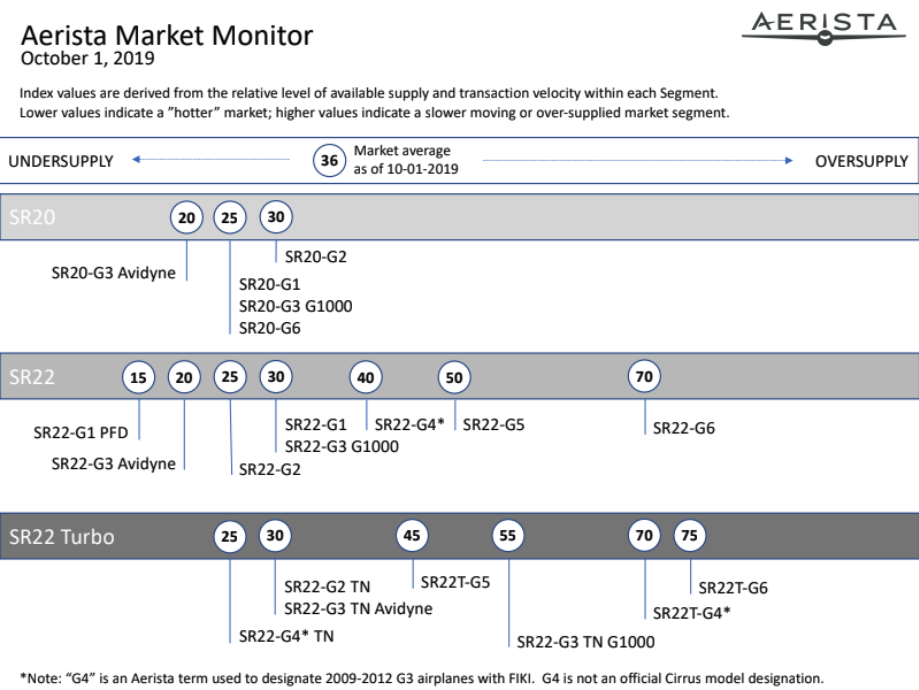

One of the new capabilities of this tool is to provide a real-time assessment of the health of any given segment, taking into account the level of available inventory, and the current/recent level of sales activity. By assigning a score to each segment, we can assess the relative strengths and weaknesses across the Cirrus market, as well as track the trends of individual segments over time.

We’re calling this the Aerista Market Monitor, and we’re excited to share some preliminary results with you on the back of this page. There will no doubt be some further refinement, but we’re excited about the new market insights that we will be able to provide.

As always, if there is anything we can help you with, or if you are interested in discussing the value of your Cirrus in today’s market, please don’t hesitate to call or write.